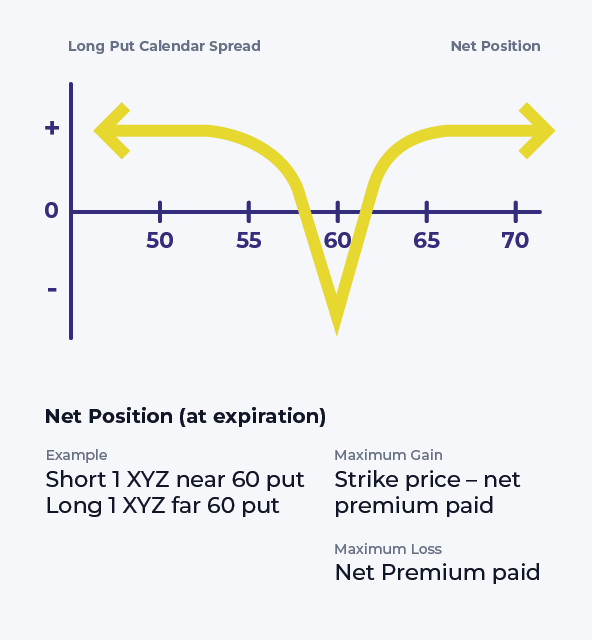

Calendar Put Spread. For example, an investor may buy a. Clicking on the chart icon on the calendar put spread screener loads.

The calendar put spread, being one of the three popular forms of calendar spreads (the other 2 being the calendar call spread and ratio calendar spread), is a neutral options strategy that profits when the underlying asset. For example, an investor may buy a.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit], The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

Calendar Put Spread Options Edge, Considering the short put option, crm is above the short strike of $240.

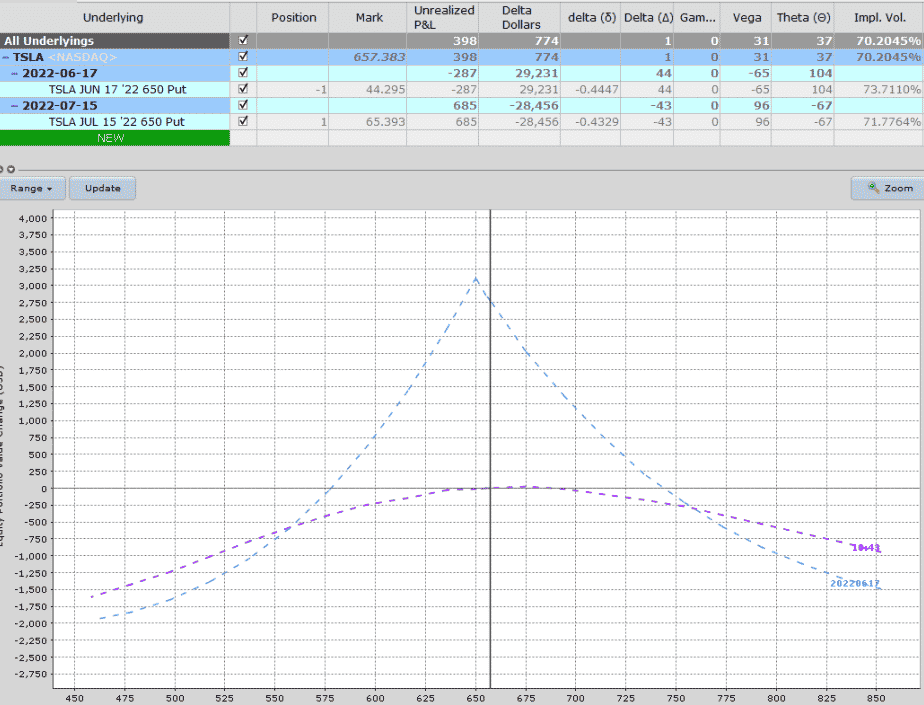

Long Calendar Spread with Puts Strategy With Example, Clicking on the chart icon on the calendar put spread screener loads.

Long Put Calendar Spread (Put Horizontal) Options Strategy, The forecast, therefore, can either be “neutral,” “modestly bullish,” or “modestly bearish,”.

Short Calendar Put Spread Staci Elladine, The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities instead of focusing.

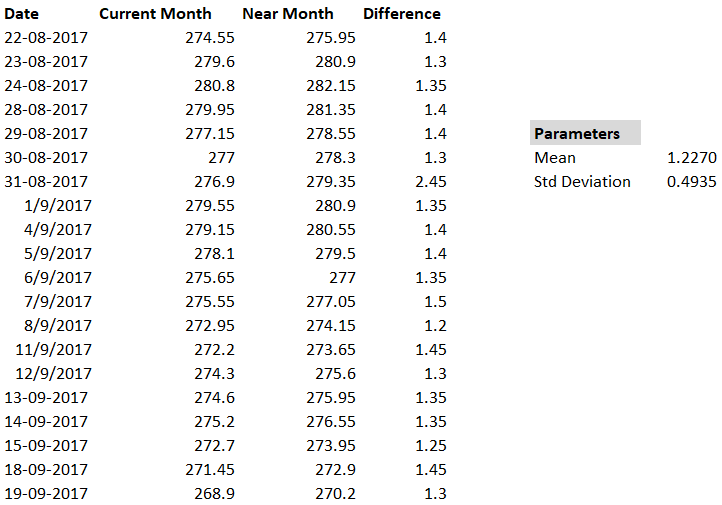

Options Trading Made Easy Ratio Put Calendar Spread, Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.

Calendar Spread Margin Norah Annelise, The calendar put spread (including leaps) is a bearish strategy.

Bearish Put Calendar Spread Option Strategy Guide, The forecast, therefore, can either be “neutral,” “modestly bullish,” or “modestly bearish,”.

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly, The calendar put spread, also known as a time spread or horizontal put spread, is an options trading strategy that involves the simultaneous purchase of a put option and the sale of.

Calendar Put Spread — Options Edge India Dictionary, The forecast, therefore, can either be “neutral,” “modestly bullish,” or “modestly bearish,”.

Sais Calendar 24-25. We will wait until we have confirmation that the building will be fully operational and we will then update the calendar. Click here for a print copy.

Fort Wayne Indiana Calendar Of Events. Museums, recreation, farmers markets and more events happening in the fort wayne area. While most events held at gwcc are. Search by date or

Sync Calendar With Outlook. Check sync settings in outlook. How to sync teams calendar with outlook; To do this, you need to ensure that you are signed in to the